Course Information

Masters in Finance, the two-year full-time course, one of its kind program was started on the recommendation of former Prime Minister Dr. Manmohan Singh. The course is uniquely designed to shape ‘Future Financial Leaders’. The course structure is inclined towards that of the London School of Economics. The program goes beyond teaching financial theories by tapping into the knowledge of finance professors and industry experts who create synergies among statistics, business strategy, operations research.

Objectives of the Course

Top finance jobs demand a sharp decision maker; someone able to grasp the finer details, as well as their significance to the bigger picture. The Master of Science in Finance course is structured to deliver a strong foundation in the principles and practice of finance, and the analytical tools and skills to form a sound basis for financial decision making. The new curriculum of M.Sc. Finance offers all the essential academic and professional skills necessary for a successful career in finance. It will develop a deep understanding of financial theories, assumptions and techniques before going on to explore fast developing specialism’s such as Fintech, Big Data and International Finance. The objective of this course is to help individuals, and the organisations which employ them, enhance their effectiveness within the field of finance.

Rationale of the Course

Mumbai is fast emerging as an International Financial Centre. This is creating opportunity for many finance professionals having internationally benchmarked skills and capabilities. At the same time, the financial markets are changing rapidly. The swift pace of financial innovation in the last decade and the recent financial turmoil has changed the landscape of the financial sector. These changes will call for novel ways of risk management and new financial regulations. The proposed M.Sc. Finance course will help create a pool of trained and globally competitive finance professionals.

Why M.Sc. Finance ?

Finance as a field of study has strong roots in other scientific fields such as statistics and mathematics. Modern financial theories, such as the Black Scholes model, draw heavily on the areas of physics, statistics and mathematics such as Brownian motion and stochastic calculus; their very creation would have been impossible if science hadn't laid the initial groundwork. Also, theoretical constructs such as the capital asset pricing model (CAPM) and the efficient market hypothesis (EMH) attempt to logically explain the behavior of the stock market in an emotionless, completely scientific manner. Finance is a practical discipline. The M.Sc. (Finance) course is designed to combine rigorous academic work with real world relevance and practical application to ensure that content is intellectually demanding while being related to the practical world of finance.

Career Scope:

The employment opportunities for trained professions are available in investment banks, brokerage houses, private equity entities, banks, insurance companies, credit rating agencies, portfolio management services, and venture capital entities.

Intake

40

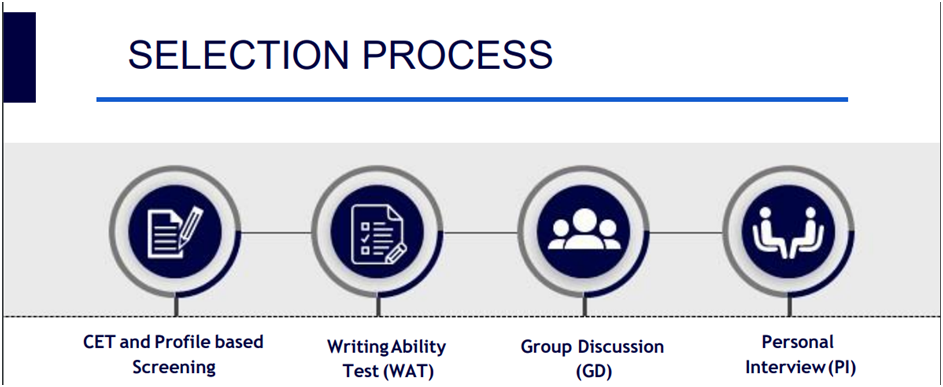

Selection Procedure/ Admission

The desirous candidates will apply on the portal of the institute for admission to M.Sc. in Finance (M.Fin.) Programme. The candidates should have appeared for MH-CET 2024 or CAT 2023 to be eligible for the process. The application form will be opened for a stipulated period for applying to the admission process of M.Sc. Finance.

The weightage criteria are as follows:

| |

Application Rating(AR) |

In-person Assessment |

Total

Score(TS) |

| Criterion |

CAT/MH-CET/UPSC

score |

PAR (Xth,XIIth,

Bachelor's

degree) |

Extra-circular/

Work Experience |

Diversity |

Total |

GA |

PI |

WAT |

Total |

0.62(AR)

+0.14(IPA) |

Weightage |

60 |

15 |

20 |

5 |

100 |

20 |

60 |

20 |

100 |

|

The minimum Total Score (TS) required to be considered for admission to M.Sc. Finance is 50 for General Category and 45 for Reserve category. Allotment Logic and Different Seat Categories: This will be as per the seat allocation done by Directorate of Technical Education, Government of Maharashtra, Mumbai for MH-CET.

Programme/Course Framework

The M.Sc. Finance course concentrates on a wide variety of questions facing financial specialists. The programme focuses on financial decision-making from a management perspective. The programme is divided into four semesters. The first semester introduces the students to the environment of accounting, finance and basic tools of analysis. This semester contains main courses: economics, quantitative methods, accounting and financial reporting, financial management, costing and control system, taxation and business law. The second semester equips the students with advanced tools such econometrics and financial modelling, and an exposure to the area of corporate finance, financial markets, fixed income securities and investment banking. This semester contains six main courses: Corporate governance and regulatory environment, corporate finance, econometrics and financial modelling, financial markets and institutions, fixed income securities and investment banking. This semester contains two practicals econometrics and financial modelling. In this semester the students must work on a research project based on summer internship under the supervision of an assignment faculty. The third semester exposes the students with advanced techniques and tools such as technical analysis, portfolio analysis, mergers and acquisition, risk in financial services and derivatives, Infrastructure and Project Financing. This semester contains six main courses: Portfolio Analysis and Management, derivatives, mergers and acquisition and corporate restructuring, technical analysis, risk in financial services, infrastructure and Project Financing. The fourth semester involves with coursework in advanced topics, and includes five courses: structured finance, international finance, behavioral finance, Business Analytics and Alternative Investments. In this semester the students must work on a dissertation (research project) under the supervision of an assignment faculty.

| Semester I |

Semester II |

Semester III |

Semester IV |

| Economics |

Corporate

Governance and

Regulatory

Environment |

Technical

Analysis |

Alternative

Investment |

Quantitative

Methods |

Corporate

Finance |

Portfolio

Analysis and

Management |

Behavioral

Finance |

Financial

Accounting,

Reporting and

Analysis |

Econometrics

and financial

Modeling |

Derivatives |

Structured

Finance |

Financial

Management |

Financial

Markets and

Institutions |

Mergers &

Acquisitions

and corporate

Restructuring |

Business

Analytics |

Costing

and Control

Systems |

Fixed

Income

Securities |

Risk in

Financial

Services |

International

Finance |

Taxation

(Direct and

Indirect) |

Investment

Banking and

PE/VC |

Infrastructure

and Project

Finance |

|

| Business Law |

Summer Project |

|

|

M.Sc. Finance at JBIMS offers a world-class generalist training in finance. Building on the foundations of quantitative finance, it combines theory and practice in topics including corporate finance, portfolio management, asset pricing, derivatives, hedge funds, private equity, behavioural finance, investment banking, and fintech. The programme is very selective and attracts outstanding students from all over the India. The course provides you with a solid grounding in finance and offers rigorous training in relevant tools and techniques and how to apply them practically in the global finance workplace.

For more information :-

Download Course Curriculum